Focos de atención

Analista, Responsable de productos de crédito, Analista de investigación de renta variable, Analista financiero, Analista de inversiones, Analista de planificación, Gestor de carteras, Analista inmobiliario, Analista de valores, Responsable de fideicomisos

Dicen que hace falta dinero para ganar dinero, e invertir es la forma más habitual de hacerlo. Desde acciones y bonos hasta bienes inmuebles y criptomonedas, la inversión es uno de los métodos más probados para obtener beneficios a largo plazo. Sin embargo, también es intrínsecamente arriesgado, ya que los mercados fluctúan todo el tiempo debido a factores que afectan a las empresas y a la economía en su conjunto. No hay ninguna garantía de recuperar la inversión, y es perfectamente posible perder todo el dinero.

Por eso, los inversores inteligentes recurren a los analistas financieros, que pueden asesorarles sobre las estrategias más adecuadas para su presupuesto, sus objetivos, su tolerancia al riesgo y sus plazos. Los analistas financieros estudian la evolución de las acciones, los bienes inmuebles y otros tipos de inversión, e intentan predecir los resultados futuros. Como hay tantos elementos humanos en la ecuación, este análisis es tanto un arte como una ciencia.

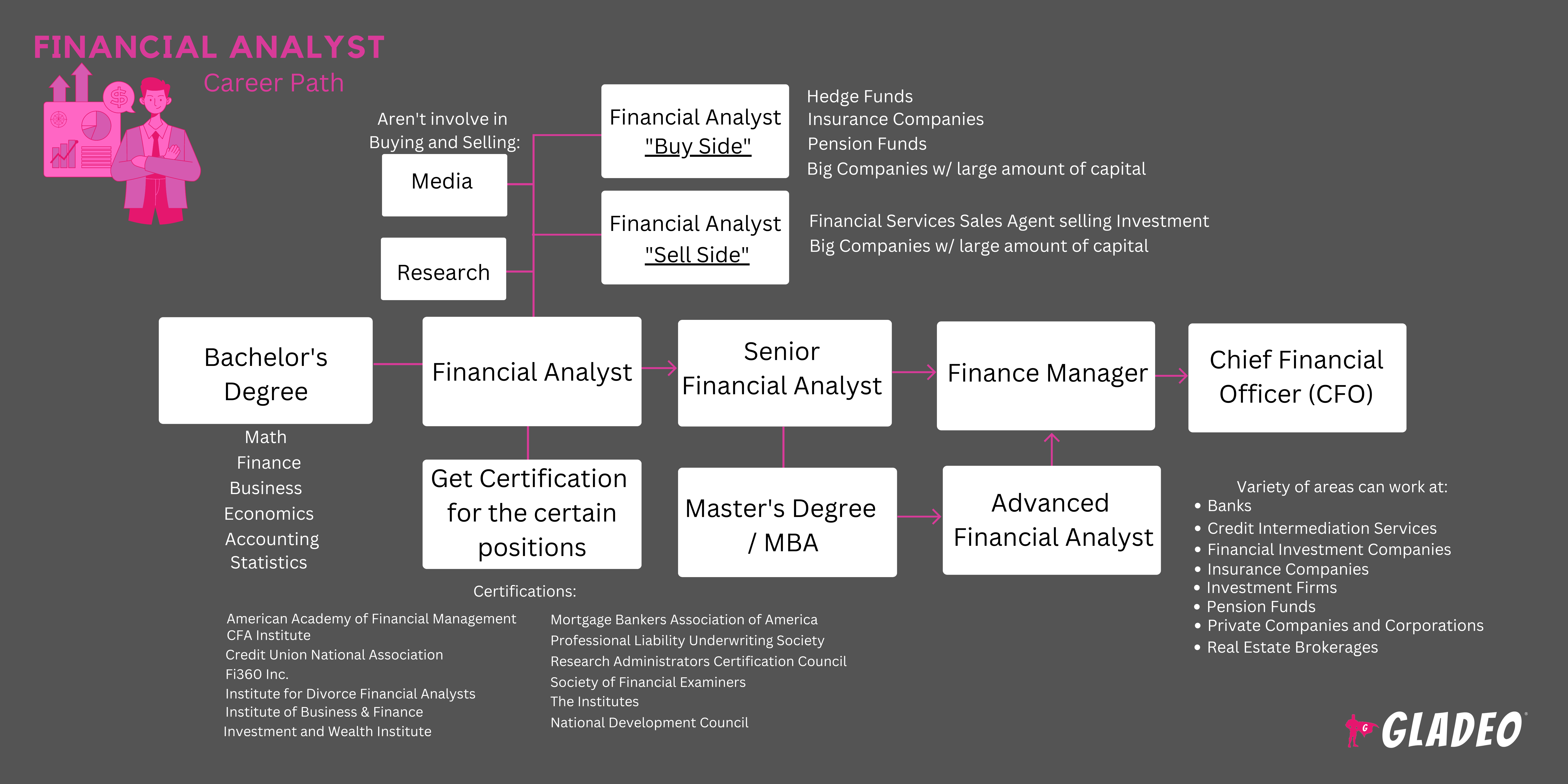

Generally speaking, Financial Analysts focus on either the “buy-side” (for hedge funds, insurance companies, pension funds, and big companies with large amounts of capital to invest) or the “sell-side” (for financial services sales agents selling investment options). Some work strictly for media and research employers who aren’t involved in buying or selling. They may specialize in particular regions, industries, or products.

El análisis financiero es un campo profesional muy amplio. El término Analista Financiero engloba a especialistas en riesgos financieros, gestores de fondos y carteras, analistas de inversiones, analistas de calificaciones y analistas de valores. Cada función varía en cuanto a funciones y ámbito de responsabilidad, pero todas están relacionadas con el dinámico campo del análisis financiero.

- Ayudar a los empresarios a obtener beneficios utilizados en beneficio de empresas o particulares

- Formar parte del mundo de la inversión, que tiene repercusiones económicas para todos los habitantes de la Tierra.

- Learning how equities (stocks), bonds, real assets (real estate, commodities like gold, oil), and cryptos function as investments

Horario de trabajo

Los analistas financieros trabajan en horarios diurnos típicos, con necesidad de hacer horas extraordinarias o trabajar por la noche en función de las necesidades del cliente. El trabajo suele realizarse en interiores, con necesidad de viajar de vez en cuando.

Tareas típicas

- Review client financials (income statements, balance sheets, cash flow) to assess their capital needs, investment budgets, and risk tolerance

- Estudiar tipos de inversión y carteras para recomendar a los clientes.

- Sugerir soluciones de inversión, reestructuración de la deuda, refinanciación y otras soluciones a los problemas financieros de una empresa.

- Preparar informes y materiales de presentación con gráficos explicativos para ayudar a los clientes a comprender las opciones.

- Estudiar empresas cuyas acciones puedan ser potencialmente buenas inversiones. Realizar las visitas necesarias

- Evaluar datos históricos de ventas inmobiliarias para prever si una propiedad es una inversión viable.

- Utilizar modelos y programas financieros para ayudar a desarrollar estrategias de inversión.

- Prestar atención a las tendencias económicas y empresariales locales, nacionales y mundiales.

- Preparar y ejecutar planes de acción aprobados para inversiones, transacciones y operaciones financieras.

- Trabajar con banqueros de inversión, contables, personal de relaciones públicas, abogados y otras partes interesadas.

- Evaluar el rendimiento de las inversiones existentes y recomendar ajustes o ventas

- Buscar nuevas oportunidades para diversificar, aumentar los beneficios potenciales y mitigar el riesgo.

- Comparar valores de distintos sectores

- Analizar datos sobre precios, rendimientos y estabilidad

- Colaborar, según sea necesario, con los organismos gubernamentales. Garantizar el cumplimiento de la normativa y la legislación.

- Ayudar a los clientes a comprender las implicaciones fiscales de las inversiones

Responsabilidades adicionales

- Manténgase al día leyendo publicaciones financieras

- Find “green” investment opportunities

- Anunciar los servicios para atraer a nuevos clientes, según sea necesario.

- Formar y orientar a los nuevos analistas

Habilidades blandas

- Escucha activa

- Adaptabilidad

- Analítica

- Orientado al cumplimiento

- Pensamiento crítico

- Orientado al detalle

- Disciplina

- Perspicacia financiera

- Paciencia

- Persistencia

- Persuasión

- Planificación y organización

- Habilidades para resolver problemas

- Escepticismo

- Buen juicio

- Gran capacidad de comunicación

- Trabajo en equipo

- Gestión del tiempo

Habilidades técnicas

- Conocimientos de matemáticas y contabilidad

- Conocimientos sólidos de economía e inversiones

- Familiarity with applicable laws governing the securities industry, such as:

- Ley Dodd-Frank de reforma de Wall Street y protección de los consumidores de 2010

- Ley de Asesores de Inversión de 1940

- Ley de Sociedades de Inversión de 1940

- Ley "Jumpstart Our Business Startups" de 2012

- Ley Sarbanes-Oxley de 2002

- Ley de valores de 1933

- Ley del Mercado de Valores de 1934

- Ley de Fideicomisos de 1939

- Analytical software such as SAS, MATLAB, Spotfire, QlikView, Tableau, and MicroStrategy

- Other digital tools including Excel, SQL, VBA, Python, and R

- Bancos

- Servicios de intermediación crediticia

- Sociedades financieras de inversión

- Compañías de seguros

- Fondos de pensiones

- Empresas privadas y corporaciones

- Corredores inmobiliarios

Los inversores confían mucho en la experiencia de sus equipos de analistas financieros. Unas buenas inversiones pueden equivaler a rentabilidad y estabilidad a largo plazo, lo que a menudo se traduce en trabajo continuo para los empleados de una empresa. Las malas inversiones pueden hacer que una empresa sufra pérdidas financieras significativas, que lleven a reducciones de plantilla, despidos de trabajadores o incluso a la quiebra.

Expectations run high and Financial Analysts must work hard to conduct thorough research and create accurate models to forecast the best investments for their clients’ needs. As Zippia points out, “while financial analysts are usually paid well, it comes at the cost of a healthy work-life balance in many cases.” Potentially long hours and the stress from so much pressure causes some analysts to experience burnout.

The economy has been seeing turbulent times, with investors riding a rollercoaster as stocks, mutual funds, ETFs, real estate, and crypto prices have fluctuated in unpredictable ways. Such volatility is the opposite of what most Financial Analysts want to see when it comes to wealth building, yet there haven’t been many safe harbors lately. There are relatively safe options such as savings accounts, bonds, treasury bills, and similar items, but the return on such low-risk investments may not even keep up with inflation. Meanwhile, some analysts do suggest taking advantage of lowered stock prices, advocating a “buy the dip” strategy while stocks are “on sale.”

The digitalization of currency has become a growing trend, with plenty of investors viewing cryptocurrencies and NFTs (non-fungible tokens) as an intriguing alternative to traditional investment vehicles. Indeed, venture capitalists alone sank over $33 billion in crypto and blockchain in 2021. Meanwhile, trading apps have utterly revolutionized how everyday people trade, which in turn impacts the overall market greatly.

Financial Analysts may have always enjoyed learning about money, how it works, and how it can be used to make even more money! Growing up, they might have been entrepreneurs who launched their own side hustles online or in-person. They could have enjoyed playing around with stocks and cryptos, trading via mobile apps and engaging in online forums. It’s possible they liked math, finance, economics, and programming classes in school. Others might have come to them for help or advice about investments, leading them to realize they could turn their skills into a well-paid profession one day!

- Para acceder a un puesto de analista financiero se requiere al menos una licenciatura en economía, finanzas, empresariales, matemáticas o una especialidad relacionada.

- Las grandes empresas pueden querer analistas con un máster, como un MBA.

- Algunas funciones de analista requieren conocimientos de física, matemáticas aplicadas y principios de ingeniería.

- There are many certifications available which can help qualify you for certain positions. These include:

- American Academy of Financial Management - Accredited Financial Analyst

- CFA Institute - Chartered Financial Analyst

- Credit Union National Association - Certified Credit Union Investments Professional

- Fi360 Inc. - Accredited Investment Fiduciary

- Institute for Divorce Financial Analysts - Certified Divorce Financial Analyst

- Institute of Business & Finance -

• Certified Income Specialist

• Certified Funds Specialist

- Investment and Wealth Institute - Certified Investment Management Analyst

- Mortgage Bankers Association of America - Certified Residential Underwriter

- Professional Liability Underwriting Society - Registered Professional Liability Underwriter

- Research Administrators Certification Council - Certified Financial Research Administrator

- Society of Financial Examiners -

• Certified Financial Examiner - Financial Analyst

• Accredited Financial Examiner - Financial Analyst

- The Institutes - Associate in Commercial Underwriting

- National Development Council - Economic Development Finance Professional

- Financial Analysts who sell products need a license through the Financial Industry Regulatory Authority (FINRA). Licensures are typically obtained after an analyst starts working

- Decide pronto si vas a cursar un máster o no. Puede resultar más fácil cursar la licenciatura y el máster en la misma universidad.

- Considere el coste de la matrícula, los descuentos y las oportunidades de becas locales (además de la ayuda federal)

- Piensa en tu horario y en tu flexibilidad a la hora de decidir si te inscribes en un programa presencial, online o híbrido

- Consulta los premios y logros del profesorado del programa para ver en qué han trabajado

- Revise las estadísticas de colocación y los detalles sobre la red de ex alumnos del programa

- Considera la posibilidad de solicitar empleos a tiempo parcial en contabilidad o finanzas.

- Estudia mucho en matemáticas, finanzas, economía, estadística, empresariales, física e informática/programación.

- Ofrécete como voluntario para actividades estudiantiles en las que puedas gestionar el dinero y aprender habilidades prácticas.

- Conozca los distintos tipos de funciones de los analistas financieros, como especialistas en riesgos financieros, gestores de fondos y carteras, analistas de inversiones, analistas de calificaciones y analistas de valores.

- Review job postings in advance to see what the average requirements are. If you know which company or employer you want to work for, ask to schedule an informational interview with one of their working analysts to learn more about their jobs and their clients’ needs

- Buscar prácticas y experiencias de cooperación en la universidad

- Anota los nombres y datos de contacto de las personas que podrían servirte de referencia en el futuro.

- Estudie libros, artículos y tutoriales en vídeo relacionados con los distintos tipos de inversión. Participar en grupos de debate en línea realistas y basados en análisis reales.

- Piense si desea especializarse en una región, sector o tipo de inversión concretos para poder adaptar su formación en consecuencia.

- Participe en organizaciones profesionales para aprender, compartir, hacer amigos y ampliar su red (consulte nuestra lista de Recursos > Sitios web)

- Obtén las certificaciones pertinentes lo antes posible para reforzar tus credenciales y ser más competitivo en el mercado laboral.

- Comienza a redactar tu currículum con antelación y ve ampliándolo a medida que avanzas, para no perder de vista nada

- Si es posible, adquiera experiencia laboral práctica antes de presentar su solicitud. Los trabajos relacionados con las finanzas, la contabilidad y los negocios se verán bien en una solicitud.

- No se necesita un máster para empezar a trabajar en este campo, pero un título de posgrado puede ponerle por delante de la competencia.

- Let your network know you are looking for work. Most job opportunities are actually discovered through personal connections

- Check out job portals such as Indeed, Simply Hired, and Glassdoor, as well as the career pages of companies you are interested in working for

- Examine cuidadosamente los anuncios y sólo presente su candidatura si está plenamente cualificado.

- Los aprendizajes relacionados con las finanzas o las experiencias cooperativas pueden ayudarte a abrirte camino. Quedan muy bien en los currículos y pueden aportar referencias personales para más adelante.

- Póngase en contacto con analistas financieros en activo para pedirles consejos sobre la búsqueda de empleo.

- Move to where the most job opportunities are! The states with the highest employment level for Financial Analysts are New York, California, Texas, Illinois, and Florida

- Muchas grandes empresas contratan a graduados de programas locales, así que pida ayuda al programa o centro de carreras de su universidad para conectarse con reclutadores y ferias de empleo

- Career centers also offer assistance with resume writing and mock interviewing!

- Pregunta con antelación a tus antiguos profesores y supervisores si pueden servir de referencias personales. No les cojas desprevenidos incluyendo sus datos de contacto sin permiso.

- Hazte una cuenta en Quora para hacer preguntas de asesoramiento laboral a trabajadores del sector

- Check out Financial Analyst resume templates to get ideas

- Adapte su currículum al puesto de trabajo que solicita, en lugar de enviar el mismo currículum a todos los empleadores

- Enumera en tu currículum todos los estudios, aptitudes, formación e historial laboral, incluidas las estadísticas sobre el rendimiento de las inversiones (si procede).

- Considere la posibilidad de que un redactor o editor profesional redacte o revise su currículum.

- Financial Analyst interview questions to prepare for those interviews

- Dress appropriately for job interview success!

- Obtenga sistemáticamente de sus empleadores/clientes un fuerte rendimiento de la inversión y constrúyales carteras que puedan capear las tormentas económicas.

- Trabaja las horas extra que necesites, para asegurarte de que das lo mejor de ti a quienes te han confiado sus fondos.

- Tómate en serio tu responsabilidad de manejar el dinero de los demás

- Comprender y cumplir todos los requisitos legales y éticos

- Utilizar los programas y técnicas más actualizados para maximizar los beneficios

- Aprende todo lo que puedas sobre los diversos aspectos del análisis financiero, al tiempo que te especializas en el campo que elijas.

- Empieza en puestos de nivel inicial y asciende a puestos de mayor responsabilidad, como gestor de cartera o gestor de fondos.

- Get your FINRA license as soon as you are able, and obtain advanced certificates when you have enough work experience

- One of the most common cers is the Chartered Financial Analyst credential offered by the CFA Institute

- Si aún no tiene un máster, considere la posibilidad de cursar un MBA por la noche mientras trabaja.

- Comunique a su jefe cuándo está preparado para abordar más proyectos o proyectos de mayor envergadura.

- Colaborar eficazmente en equipos, mantener la cabeza fría y la concentración, y demostrar liderazgo cuando surjan oportunidades.

- Amplíe su red de contactos participando en organizaciones profesionales

Páginas web

- Academia Americana de Gestión Financiera

- Asociación de Profesionales Financieros

- Instituto CFA

- Asociación Nacional de Cooperativas de Crédito

- Fi360 Inc.

- Autoridad Reguladora de la Industria Financiera

- Academia Global de Finanzas y Gestión

- Instituto de Analistas Financieros de Divorcios

- Institute of Business & Finance

- Instituto de Inversión y Patrimonio

- Asociación de Banqueros Hipotecarios de América

- Consejo Nacional de Desarrollo

- Sociedad de suscripción de responsabilidad profesional

- Consejo de Certificación de Administradores de Investigación

- Sociedad de Examinadores Financieros

- Los Institutos

Libros

- Fundamental Analysis for Beginners: Grow Your Investment Portfolio Like A Pro Using Financial Statements and Ratios of Any Business with Zero Investing Experience Required, by A.Z Penn

- Investing 101: From Stocks and Bonds to ETFs and IPOs, an Essential Primer on Building a Profitable Portfolio, by Michele Cagan CPA

- Technical Analysis of the Financial Markets: A Comprehensive Guide to Trading Methods and Applications, by John J. Murph

- The Essentials of Financial Analysis, by Samuel Weaver

Trabajar como analista financiero puede ser estresante a veces, sobre todo cuando la economía es inestable y resulta más difícil obtener un buen rendimiento de las inversiones. A menudo se culpa a los analistas de resultados basados en factores que escapan a su control. Según la Oficina de Estadísticas Laborales, algunas profesiones afines a tener en cuenta son:

- Analista presupuestario

- Director Financiero

- Suscriptor de seguros

- Asesor financiero personal

- Agente de ventas de valores, materias primas y servicios financieros

In addition, O*Net Online lists the below-related fields:

- Analista de crédito

- Especialista en riesgos financieros

- Gestor de fondos de inversión

Newsfeed

Trabajos destacados

Cursos y herramientas en línea